ALL COUNTRIES:

December 1, 2020 @ 9:13 AM By Pavel Demeshchik

Experienced entrepreneurs know that building successful products is not about damn luck or revolutionary startup ideas; it’s more about data-driven decisions and careful analysis of the market. There are plenty of books and posts written on this topic, but it still takes days of research to create some sort of a mindmap and understand startup metrics and their common use cases.

This post is a quick cheat sheet for entrepreneurs to figure out what metrics may be useful to their startup or business.

Let’s assume that we are building a social network, and our business model is ad-based. The longer the average session duration in our app, the better, right? It means that our ads will get more impressions from our app users.

But what if we are building not a social network, but a search engine? Is it a positive change when the average session duration grows? Or it means that our UX is getting worse, and users have to spend more time looking for the requested information?

And lastly, what does the average session duration mean for a SaaS application like GitHub or Slack?

The problem here is that startups try to create something unique by definition and cannot use the same metrics as a measure of their success/progress.

Sometimes, a metric has opposite meanings for different business models.

In order to provide you with any recommendations, we need to find similarities in startup businesses and group them up somehow. I believe that the two main factors that define what metrics are more important for your business are:

Business Model

All the efforts of any business are always focused on the only goal: profits maximizing. A business model defines revenue sources and all the financial metrics that depend on it.

Current Stage

In the beginning, every startup faces an atmosphere of extreme uncertainty. As it progresses over time, it validates business hypotheses one by one and picks more and more precise metrics to rely on.

To read further about metrics, make sure you know about different business models and startup stages and can define yours.

Note: In terms of this post, we don’t discuss the business models that assume uneven revenue distribution across customers. If your business provides a service to one or two big clients that generate 80% of your revenue, data analysis won’t be as helpful as for the business models above.

It’s important to understand that you can track both absolute values of a metric, as well as its change compared to the previous period of time when it makes sense. When you need to see how a certain metric grows over time, you can use Month-over-Month (MoM), Quarter-over-Quarter (QoQ), or Year-over-Year (YoY) metrics.

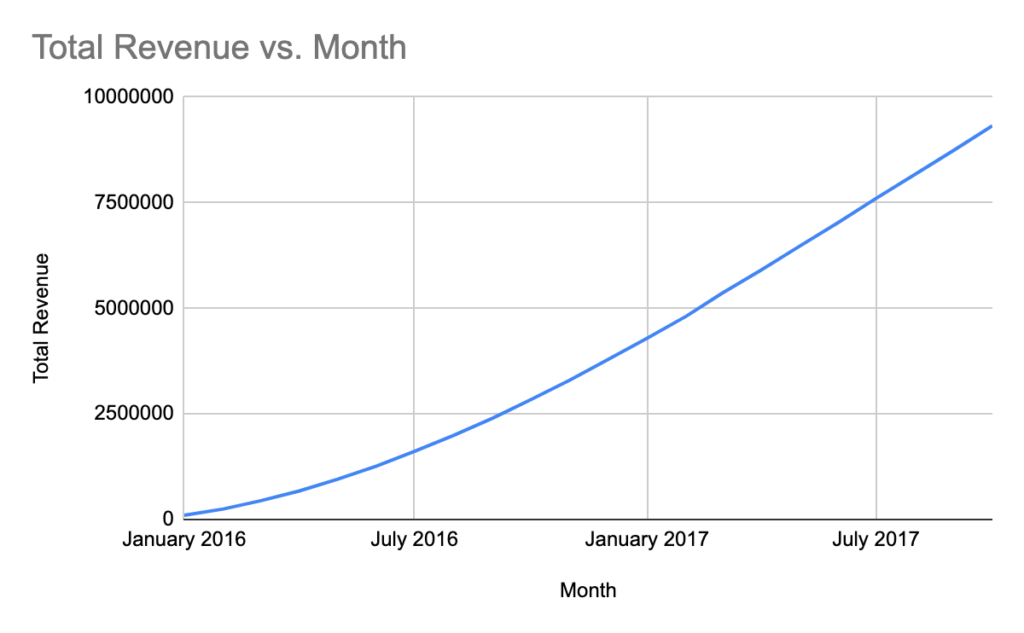

The most common use of this type of metric is Revenue Growth, which is featured in the table below, but you can apply it to any other metric when it makes sense. To give you an example, let’s compare Total Revenue vs. Monthly Revenue vs. Month-over-Month Revenue Growth of a company below.

Here is the graph of its Total Revenue:

Looks good, right?

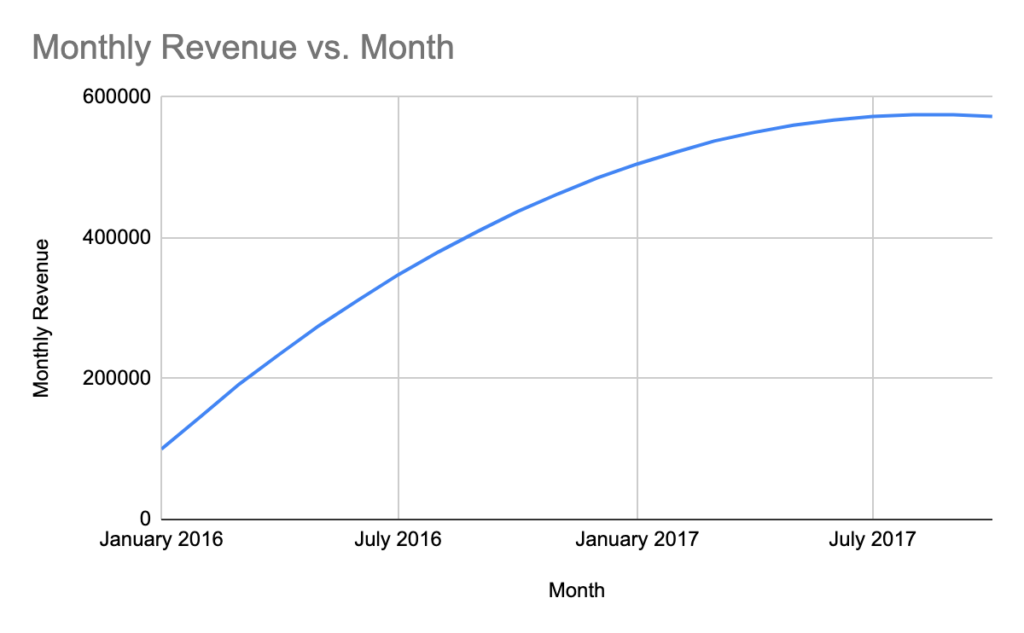

Seems like the company is growing. But wait a minute, this is Total Revenue Graph which adds up new revenue on top of what they already earned. To be honest, the Total Revenue graph doesn’t make a lot of sense and is used pretty often to impress prospect investors. Let’s review Monthly Revenue graph of the same company:

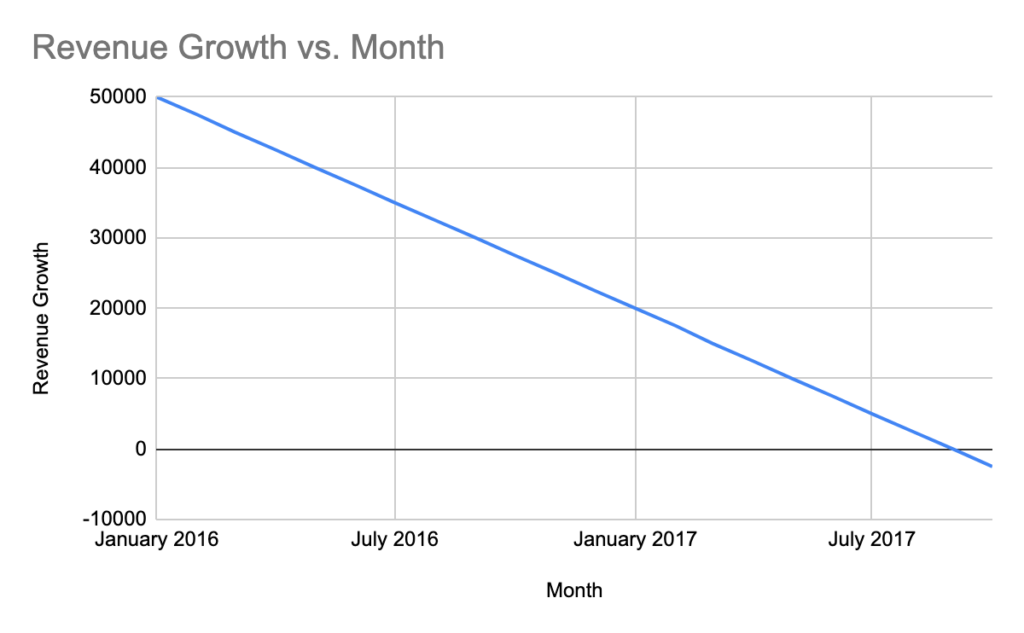

Seems like it’s not that good. What experienced entrepreneurs and investors pay more attention to is the Month-over-Month (MoM) Revenue Growth graph, and for this company, it looks like below:

This MoM Revenue Growth graph clearly shows that the company stopped growing. Moreover, it started shrinking. This may indicate that it’s business model doesn’t scale well.

Tracking a whole bunch of different metrics is difficult, especially when each one of them has its own priority, and your team is growing quickly. That’s why many businesses try to measure their success/growth using just one metric and call it North Star Metric (NSM). Here are some notes about using NSM based on our experience:

Here are some good NSM examples:

| Company | NSM |

|---|---|

| Daily Active Users | |

| Uber | Weekly Rides |

| Walmart | Average Number of Items Bought |

| Average Number of Messages Sent | |

| Quora | Number of Questions Answered |

If you’d like to learn more, have a look at an example of how Thoughtbot calculates its NSM.

This is the type of metric that indicates where your business stands currently. Usually, financial metrics are not actionable, but show overall success/potential of your business.

| Metric | Description | Formula | Stages | Business Models |

|---|---|---|---|---|

| Revenue / Net Sales | Revenue is the value of all sales of goods and services recognized by a company in a period. Note: Revenue is often considered the “Top Line” of scaling and established businesses. |

Revenue = Σ Goods / Services sales | MVP, Scaling, Established | All |

| Profit Margin / Net Profit Margin | Represents what percentage of sales has turned into profits. Simply put, the percentage figure indicates how many cents of profit the business has generated for each dollar of sales. Note: Profit margins are used by investors and businesses themselves as indicators of a company’s financial health. This is extremely important for established business as it reflects their success, but not so important on early stages. |

Profit margin = Net Profit (Income) ⁄ Revenue x 100 | MVP, Scaling, Established | All |

| Monthly Recurring Revenue (MRR) | The amount of money paid monthly for subscriptions for your product or service. Note: Having recurring revenue is important for investors as this type of revenue easier to predict and grow. Another important metric is MRR vs Total Revenue that displays how stable your revenue stream is. |

MRR = Σ Recurring Revenue (for any given month, simply sum up the recurring revenue generated by that month’s customers to arrive at your MRR figure.) | MVP, Scaling, Established | Subscription-based, IoT |

| Revenue Growth | Revenue growth shows how fast your revenue is growing in comparison to previous periods of time. Note: Usually, measured every month (MoM, QoQ, YoY), see the graphs above. |

Revenue Growth = (Current period revenue – Prior Period Revenue) / Prior Period Revenu | Scaling | Marketplace, Ad-based, Aggregator |

| MRR Growth | Measures how your monthly recurring revenue (MRR) grows over time. For a more accurate picture, you can break down your MRR into New MRR, Expansion MRR, and Churned MRR. This way, you can see what exactly drives your MRR growth. Learn more about it in this SaaS metrics guide. Note: Similar to Revenue Growth, but for MRR. See the graphs above for an example. |

MRR Growth = Current period MRR – Prior Period MRR) / Prior Period MRR | Scaling | Subscription-based, IoT |

| Average Revenue per User (ARPU) | The revenue generated per user/account. It simply involves taking the total revenue in a given time period by the number of users in that period. Note: Startup pay more attention to ARPU at later stages when trying to introduce new monetization strategies (e.g., upsell their existing customers). This metric is also useful when you experiment with different types of customers to find out the portrait of your ideal customer and narrow down your target audience. |

ARPU = Total Revenue / # of Users | Scaling, Established | All |

| Total contract value (TCV) | The measure of the value a customer has committed to you in contracts or orders. It does not match the revenue you get in the end though. Note: It’s important to understand that you can measure Contracts Value if you don’t have your product ready yet. It helps to validate your business idea at the early stages. Measured vs. Revenue to see how much of contract value converts into actual revenue in the end. |

The formula varies for every segment | All | Marketplace, Aggregator |

| Gross Merchandise Value (GMV) | Refers to the total volume in dollars of sales over a given time period on e-commerce sites such as eBay. GMV is calculated before accrued expenses are deducted. The accrued expenses include costs associated with advertising/marketing, delivery costs, discounts, and returns. Note: Measured vs. Revenue to learn how your Merchandise Value influences your actual Revenue. |

GMV = Sales Price of Goods x Number of Goods Sold | Scaling, Established | Marketplace |

| Unit Cost | A total expenditure incurred by a company to produce, store, and sell one unit of a particular product or service. Note: Measured over time. The more units you produce, the cheaper they should be. Otherwise, your business model may be hardly scalable. |

Unit Cost = Variable Costs + Fixed Costs / Total Units Produced | Scaling, Established | Marketplace, IoT |

| Burn Rate + Runway | Burn Rate is the actual amount of cash your account has decreased by in one month. RunWay is the # months before you run out of money. | Burn Rate = Cash balance (prior month) – Cash balance (current month) Average Burn Rate = (Σ Monthly Burn Rates) / # of month Runway = Total cash held / Average burn rate |

MVP, Scaling | All |

These are the type of metrics that indicate how fast your business grows. With the help of these metrics, you can project your financial KPIs.

It’s important to note here that all the acquisition metrics are usually tracked against different acquisition channels (blended, organic, paid marketing, etc.) to determine the most effective ones.

| Metric | Description | Stages | Business Models |

|---|---|---|---|

| Downloads Page Views Sessions |

These do not require any explanation basically. Note: Not actionable vanity metrics. But they are easy to measure and can be used to evaluate interest to your product at the early stages. |

Prototype, MVP | All |

| Sign-ups | The number of users who signed up for your service (e.g., provided a piece of their personal data). Note: Another vanity metric, but more reliable than Page Views, for example. It collects valuable data about users such as email or phone numbe, which you can use later to involve users in your funnel. |

Prototype, MVP | All |

| New Users | The number of new users | MVP, Scaling, Established | All |

| Conversion Rate Activation Rate |

Conversion rate is the percentage of visitors who take the desired action. Conversions don’t have to be sales but can be any key performance indicator (KPI) that matters for your business. Activation rate is the rate at which your acquired customers become active customers by initiating an activation event. For example, a user created the first order on a platform. Note: Actionable. May indicate bottlenecks in your application. Usually, Conversion Rate is measured for a sequence of actions that lead to the final desired effect (purchase in most cases), which creates a Conversion Funnel. Using Conversion Funnels is an effective way to improve the UX of your product by increasing Conversion Rates at every step. It’s important to define the desired action and activation event for your product. Some product owners define signup as their activation event which, doesn’t make a lot of sense but allows them to show impressive figures in “active users” graphs in their investor decks. |

All | Marketplace, IoT, Subscription-based, Aggregator |

| Click-Through Rate (CTR) | A click-through rate (CTR) is the ratio of clicks to overall impressions. Note: Usually applied to ads like Conversion Rate of Ads. Extremely important for Ad-Based products as it reflects the actual value that Ad-Based businesses bring to their customers. Also can be measured for any other types of businesses that consider paid ads as one of their major acquisition channels. |

Scaling, Established | Ad-based |

| Cost per Signup | The average amount of resources you spend on a new sign-up. Note: Very useful in the beginning when you still validate your idea and run experiments that affect your product value assumptions. At later stages, it’s better to rely on CAC or CPAU. |

Prototype,MVP | IoT, Subscription-based |

| Customer Acquisition Cost (CAC) Cost per Activated User (CPAU) |

The measure of the value a customer has committed to you in contracts or orders. It does not match the revenue you get in the end though. Note: It’s important to understand that you can measure Contracts Value if you don’t have your product ready yet. It helps to validate your business idea at the early stages. Measured vs. Revenue to see how much of contract value converts into actual revenue in the end. |

Scaling, Established | Marketplace, IoT, Subscription-based, Aggregator |

| Virality Coefficient (K-factor) | A viral coefficient is a number that indicates how many new users a current user is referring to your business. This metric is used to measure the organic growth of a company. A viral coefficient of 0.5 means that for every 10 users you acquire (through ads, blogging, affiliates, etc.), you’re also getting another 5 on top, which lowers your cost per acquisition. So your main goal is to define a strategy on how to count the number of new users generated from the actions of your existing users. Note: Your growth engine to be considered viral, when your Virality Coefficient is greater than 1.0 |

MVP, Scaling | Ad-Based |

If acquisition metrics show how fast you grow, then engagement metrics indicate the quality of your growth and value you bring to your customers. Sooner or later, every business starts to focus on this type of metrics, especially in a competitive market.

| Metric | Description | Stages | Business Models |

|---|---|---|---|

| Monthly Active Users (MAU) | The number of unique users who engage with your product monthly. Note: A common caveat here is your Active User definition. It differs from business to business. Some of them define Monthly Active User as a user who opened their app at least once that month. Others consider a user as Active only if they made a conversion (ex: purchase). |

All | Marketplace, Subscription-based, IoT, Aggregator |

| Daily Active Users (DAU) | The number of unique users who engage with your product daily. Note: This is the core metric for ad-based businesses that they focus on heavily as it defines their revenue. |

All | Ad-based |

| Customer Lifetime Value (CLV) | The average revenue a business expects from a single customer during their lifetime. Note: CLV:CAC ratio should be around 1:4 or more for sustainable growth. As acquisition metrics, it makes sense to track it against different acquisition channels. |

Scaling, Established | All |

| Churn Rate | The percentage of active users who stopped using your product/service in a specified period of time. | Scaling, Established | All |

| Reactivated Users | Users who begin to purchase, subscribe, or engage with your app again after a long inactive phase. Note: It’s easier to reactivate such users instead of acquiring new ones because they demonstrated their interest in your product once, and you have their contact details. |

Established | All |

| Average Session Duration | The average amount of time users spend on your website or in your app during one session. Note: A vanity engagement metric that is available out of the box in many analytic tools. It can be useful to see user engagement at the early stages. |

Prototype,MVP | All |

| Data Volume | The amount of data collected and available for use per period of time. Note: A similar vanity metric for early-stage IoT businesses. |

Prototype, MVP | IoT |

| Retention Rate | The percentage of users who use your app a certain number of days after their first engagement with the product. CRR = ((E-N)/S))*100 E = the number of customers you have at the end of the week/month/year or other duration N = the number of new customers your business made a sale to or acquired in some other way during a given period S = the number of customers you had at the start of the period |

MVP, Scaling, Established | All |

| Average Session Duration | The average number of key actions taken per session or period of time. Note: It may reflect the value you bring to your customers. Examples: Monthly Bookings, Daily Purchases, Daily Messages. |

Prototype, MVP | All |

| Net Promoter Score (NPS) | A customer loyalty score is taken from asking customers how likely they are to recommend your product or service to others. NPS = % promoters – % detractors Promoters (score of 9 and 10) Detractors (score of 0 to 6, included) Note: Used to evaluate overall user satisfaction and receive feedback. |

Established | All |

These metrics can be a good start for measuring your startup success, growth, and value. Choose your metrics wisely and reconsider them every time you change the strategy or move to the next stage. While you grow and gain more experience, you will be able to create the whole economy for your product with built-in custom metrics.

When performing a user engagement analysis, every business is trying to define their “sticky criteria” – an action or a sequence of actions that, with high probability, will convert a user into a long-time customer. Having a defined sticky criterion, you can focus on your marketing efforts and rebuild UX of your product to inspire your users to follow that lead.

In our next post, we’ll describe how Cohort Analysis works and how it helps to define your sticky criteria and make user engagement forecasts.

About the author:

I have passed a long way from Software Engineer to CEO of own software development company. During the last 6 years, I've participated in 20+ IT projects and gained experience in a variety of business domains such as entertainment, social media, ridesharing, advertising, banking, real estate, and many more.